Do you own or lease a car in Australia?

Do you use your car for work purposes?

If so, this app is for you!

Deduct My Car is a simple tax tool calculator that will calculate the amount of work-related car expenses that you can claim on your Australian Income Tax Return.

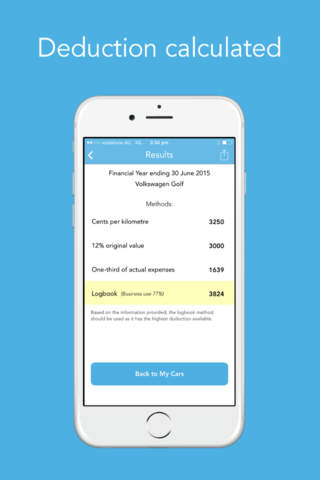

There are four methods that can be used to determine your motor vehicle deduction. Based on the information you have provided, the app will automatically determine your eligibility and calculate your deduction under each of these four methods. It will also advise which of the four methods should be used that will provide the highest deduction available.

If you have more than one vehicle, you can simply add another car and it will save all the information for each individual car.

Features include:

- calculates your deduction for the 2013, 2014 and 2015 Financial Year

- automatically calculates depreciation for your motor vehicle

- email results directly from the app

- provides more information based on the ATO guidelines for some motor vehicle questions

Deduct My Car has been developed by an Australian Chartered Accountant and every effort has been made to ensure that the material contained on this application is factually correct. We recommend that you seek professional advice prior to making a motor vehicle deduction on your tax return.